Live in USA

|

Interest is a fee paid by a borrower of assets to the owner as a form of

compensation for the use of the assets. It is most commonly the price paid for

the use of borrowed money,1 or money earned by deposited funds.2

When money

is borrowed, interest is typically paid to the lender as a percentage of the

principal, the amount owed to the lender. The percentage of the principal that

is paid as a fee over a certain period of time (typically one month or year) is

called the interest rate. A bank deposit will earn interest because the bank is

paying for the use of the deposited funds. Assets that are sometimes lent with

interest include money, shares, consumer goods through hire purchase, major

assets such as aircraft, and even entire factories in finance lease

arrangements. The interest is calculated upon the value of the assets in the

same manner as upon money.

Interest is compensation to the lender, for a)

risk of principal loss, called credit risk; and b) forgoing other investments

that could have been made with the loaned asset. These forgone investments are

known as the opportunity cost. Instead of the lender using the assets directly,

they are advanced to the borrower. The borrower then enjoys the benefit of using

the assets ahead of the effort required to pay for them, while the lender enjoys

the benefit of the fee paid by the borrower for the privilege. In economics,

interest is considered the price of credit.

Interest is often compounded,

which means that interest is earned on prior interest in addition to the

principal. The total amount of debt grows exponentially, most notably when

compounded at infinitesimally small intervals, and its mathematical study led to

the discovery of the number e.3 However, in practice, interest is most often

calculated on a daily, monthly, or yearly basis, and its impact is influenced

greatly by its compounding rate.

According to historian Paul Johnson, the

lending of "food money" was commonplace in Middle East civilizations as far back

as 5000BC. They regarded interest as legitimate since acquired seeds and animals

could "reproduce themselves"; whilst the ancient Jewish religious prohibitions

against usury were a "different view".4

In the Roman Empire, interest rates

were usually calculated on a monthly basis and set as multiples of 12,

apparently for expedient calculation by the wealthy private individuals that did

most of the moneylending.5

The First Council of Nicaea, in 325, forbade

clergy from engaging in usury6 which was defined as lending on interest above 1

percent per month (12.7% APR). Later ecumenical councils applied this regulation

to the laity.67 Catholic Church opposition to interest hardened in the era of

scholastics, when even defending it was considered a heresy. St. Thomas Aquinas,

the leading theologian of the Catholic Church, argued that the charging of

interest is wrong because it amounts to "double charging", charging for both the

thing and the use of the thing.

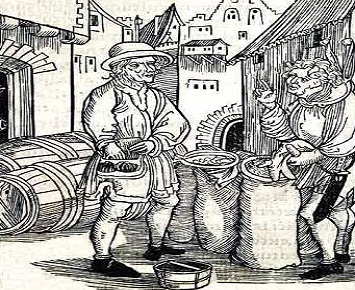

In the medieval economy, loans were entirely

a consequence of necessity (bad harvests, fire in a workplace) and, under those

conditions, it was considered morally reproachable to charge interest.citation

needed It was also considered morally dubious, since no goods were produced

through the lending of money, and thus it should not be compensated, unlike

other activities with direct physical output such as blacksmithing or farming.8

For the same reason, interest has often been looked down upon in Islamic

civilization, with most scholars agreeing that the Qur'an explicitly forbids

charging interest.

Medieval jurists developed several financial instruments

to encourage responsible lending and circumvent prohibitions on usury, such as

the Contractum trinius.

Download